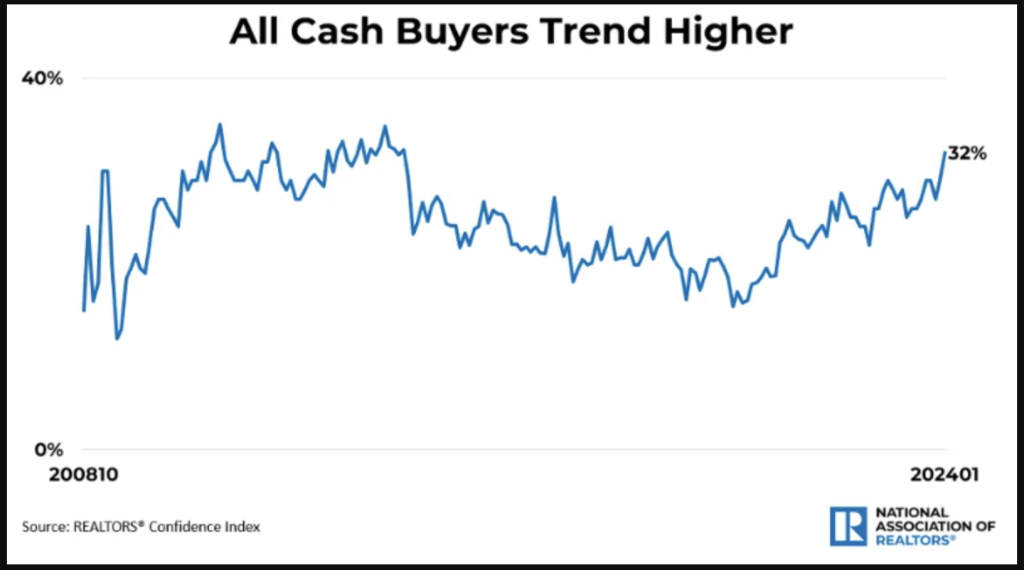

Cash Buyers Highest in 10-Years

- Highest all-cash buyer numbers since 2014.

- United States Treasury Department to impose a rule on all cash reporting for Real Estate transactions.

- Investment properties showing to be the highest rate of purchase.

While mortgage interest rates have gone up from their lowest points in recent years, the proportion of buyers paying in cash has reached its highest point in ten years. Last time numbers were as high in recent years was 2014.

As of January, the National Association of Realtors (NAR) reports that 32% of home sales were made by buyers paying in cash. This marks a significant increase since October 2022, with over a quarter of recent home purchases being made without financing.

The surge in cash transactions coincides with the U.S. Treasury Department’s Financial Crimes Enforcement Network (FinCEN) proposing a rule that would require specific individuals involved in real estate closings to report information on all-cash residential transactions nationwide, especially those involving legal entities and trusts. You can find more details about the proposed rule here.

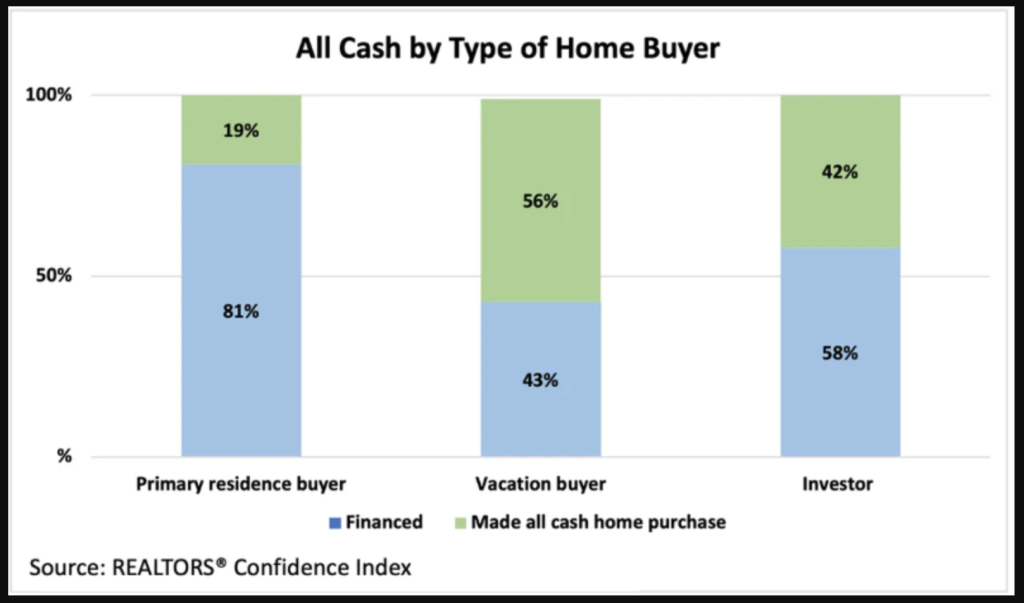

According to data from the last six months of the NAR’s Confidence Index, these cash buyers are more likely to be vacationers and investors. However, individuals purchasing homes for their primary residence are also actively using cash for their transactions.

According to Jessica Lautz, the deputy chief economist and vice president of research at the National Association of Realtors (NAR), all-cash purchases by primary residence buyers have gone up in the past two years. These buyers already owned a home, sold it, and were able to buy their next property without needing a mortgage. This ability to make a cash purchase was likely made possible because they had earned a significant amount of housing equity from the rising home prices in recent years.

SIMILAR ARTICLES